Groupon/CityDeal: Bei 126 Millionen Dollar Bewertung, 170 Millionen Dollar mitnehmen und 10,3 % der Anteile behalten

Im Zuge des angekündigten Börsenganges von Groupon (www.groupon.com), der 750 Million US-Dollar bringen soll, kommen nun auch zahlreiche Details zur Übernahme von CityDeal, das im Mai 2010 von der US-Firma komplett übernommen wurde, an Licht. Im Börsenprospekt heißt es zu dieser Übernahme: “Under the terms of the CityDeal Agreement, by and among the Company, CityDeal, CD-Rocket Holding UG (“Rocket Holding”), CityDeal Management UG (“CityDeal Management”) and Groupon Germany Gbr (“Groupon Germany”), Rocket Holding and CityDeal Management transferred all of the outstanding shares of CityDeal to Groupon Germany, in exchange for $0.6 million in cash and 41,400,000 shares of the Company\’s voting common stock (valued at $125.4 million as of the acquisition date), and CityDeal merged with and into Groupon Germany with CityDeal as the surviving entity and a wholly-owned subsidiary of the Company. The Company delivered 19,800,000 of such shares of voting common stock in May 2010, with the remaining 21,600,000 shares delivered as of December 31, 2010, due to the achievement of financial and performance earn-out targets discussed below”.

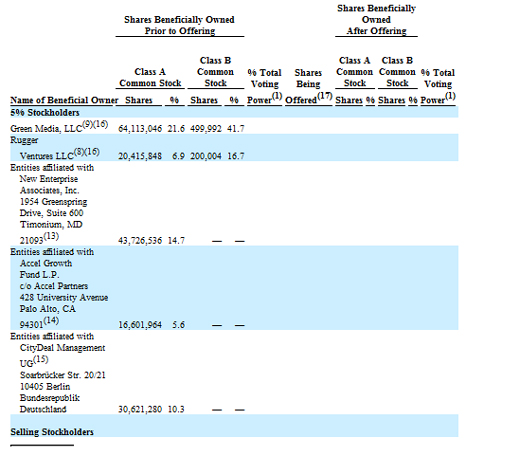

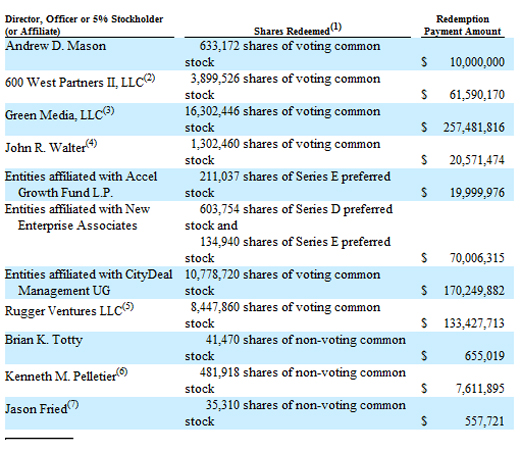

Wie damals vermutet, wechselte CityDeal somit für einen dreistelligen Millionenbetrag – in Form von ganz wenig Bargeld und ganz vielen Anteilen – den Besitzer. Zu den Gesellschaftern von CityDeal gehörten neben Rocket Internet auch Holtzbrinck Ventures, eVenture Capital Partners und Investment AV Kinnevik. Die Investoren um die drei Samwer-Brüder halten heute noch 10,3 % der Groupon-Anteile (siehe oben). Von den ursprünglichen 41.400.000 Anteilen machte die Investorengruppe bereits 10.778.720 Anteile zu Geld und bekam dafür 170,2 Millionen Dollar (siehe unten). Die restlichen 30,621,280 warten noch auf die Vergoldung!

Einige weitere spannende Details zur Übernahme von CityDeal, den geschlossenen Beraterverträgen samt Laufzeit und den gemeinsamen Aktivitäten von Rocket Asia und Groupon in Fernost dokumentieren wir an dieser Stelle:

CityDeal Acquisition. On May 15, 2010, we entered into and consummated a Share Exchange and Transfer Agreement by and among CD-Inv Holding UG (“Holding”), CD-Rocket Holding UG (“Rocket Holding”), CityDeal Management UG (“CityDeal Management”), CityDeal Europe GmbH (“CityDeal”), Groupon Germany Gbr (“Groupon Germany”) and Groupon, Inc., pursuant to which Rocket Holding and CityDeal Management transferred all of the outstanding shares of CityDeal to Groupon Germany in exchange for 19,800,000 shares of our voting common stock, and CityDeal merged with and into Groupon Germany with CityDeal as the surviving entity and a wholly-owned subsidiary of Groupon. An additional 21,600,000 shares of our voting common stock were issued to Rocket Holding and CityDeal Management on December 1, 2010, as contingent consideration for the merger. As a result of the merger, Holding, Rocket Holding and CityDeal Management, entities affiliated with Oliver Samwer, Marc Samwer and Alexander Samwer, acquired an aggregate of 41,400,000 shares of our voting common stock representing 10.3% of the total outstanding voting shares. Our founders may vote the shares held by Holding, Rocket Holding and CityDeal Management. See “Principal and Selling Stockholders” for further information.

CityDeal Loan Agreement. In May 2010, we and the former CityDeal shareholders (including Oliver Samwer, Marc Samwer and Alexander Samwer, collectively the “Samwers”) entered into a loan agreement to provide CityDeal with a $20.0 million term loan facility (the “Facility”). The Facility subsequently was amended on July 20, 2010 increasing the total commitment to $25.0 million. Each of the Company and the former CityDeal shareholders was obligated to make available $12.5 million under the terms of the Facility. The entire $25.0 million under the Facility was disbursed to CityDeal during 2010. Proceeds from the Facility were used to fund operational and working capital needs. The outstanding balance accrued interest at a rate of 5% per annum. The outstanding balance and accrued interest were payable upon termination of the Facility, which was the earlier of any prepayments or December 2012. In March 2011, CityDeal repaid all amounts outstanding to the former CityDeal shareholders related to the Facility.

Consulting Agreement with Oliver Samwer. On May 12, 2010, CityDeal entered into a consulting agreement with Oliver Samwer, pursuant to which Mr. Samwer advises CityDeal with respect to its goals and spends at least fifty-percent of his work hours consulting for CityDeal. CityDeal reimburses Mr. Samwer for travel and other expenses incurred in connection with his service to CityDeal. Mr. Samwer does not receive any additional compensation from CityDeal or Groupon in connection with his consulting role. The term of Mr. Samwer\’s consulting agreement expires on October 18, 2011. We paid $0.1 million to reimburse Mr. Samwer for travel and other expenses for 2010.

Consulting Agreement with Marc Samwer. On May 12, 2010, CityDeal entered into a consulting agreement with Marc Samwer, pursuant to which Mr. Samwer advises CityDeal with respect to its goals and spends at least fifty-percent of his work hours consulting for CityDeal. CityDeal reimburses Mr. Samwer for travel and other expenses incurred in connection with his service to CityDeal. Mr. Samwer does not receive any additional compensation from CityDeal or Groupon in connection with his consulting role. The term of Mr. Samwer\’s consulting agreement expires on October 18, 2011. We paid less than $0.1 million to reimburse Mr. Samwer for travel and other expenses for 2010.

Management Services. CityDeal entered into agreements with Rocket Internet GmbH (“Rocket”) and various other companies in which the Samwers have direct and/or indirect ownership interests to provide information technology, marketing and other services to CityDeal. CityDeal paid $1.4 million to Rocket and a total of $0.2 million to the other companies for services rendered for 2010. In April 2011, this arrangement terminated and the personnel primarily responsible for the services provided to us became our employees.

Merchant Contracts. CityDeal entered into several agreements with merchant companies in which the Samwers have direct and/or indirect ownership interests, and, in some cases, who are also directors of these companies, pursuant to which CityDeal conducts its business by offering goods and services at a discount with these merchants. CityDeal paid in total $1.1 million to these companies under the merchant agreements for 2010.

E-Commerce King Limited Joint Venture (China). On January 14, 2011, Groupon, B.V. entered into a joint venture with Rocket Asia GmbH & Co. KG, an entity affiliated with the Samwers (“Rocket Asia”), TCH Burgundy Limited (“Tencent”) and Group Discount (HK) Limited (“Yunfeng”). Pursuant to the joint venture arrangement, Groupon B.V. and Tencent each own 40% of E-Commerce King Limited (“E-Commerce”) and Rocket Asia and Yunfeng each own 10% of E-Commerce. Pursuant to a shareholders agreement entered into in connection with the joint venture, the board of directors of E-Commerce consists of a director appointed by a subsidiary of Groupon, a director appointed by Rocket Asia, who is Oliver Samwer, and two directors appointed by Tencent. Each of the parties to the joint venture also has rights of co-sale and first refusal pursuant to the shareholders agreement.

Artikel zum Thema

* Entlassungen bei CityDeal/Groupon

* Groupon-Fieber: Weitere Details zur Übernahme. CityDeal soll Groupon in alle Welt bringen

* Warum kauft Groupon den Klon CityDeal? – Gründer Andrew Mason nimmt Stellung

* Millionenschwerer Exit: Groupon schluckt deutschen Klon CityDeal